TLDRs;

- Apple stock fell 1.05% to $209.05 despite a projected 4.2% Q3 revenue growth.

- Analysts expect Q3 earnings of $1.43 per share and $89.3B in total revenue.

- Tariff pressures and delayed AI expansion weigh on investor sentiment.

- iPhone sales climb, but other device categories and AI rollout remain concerns.

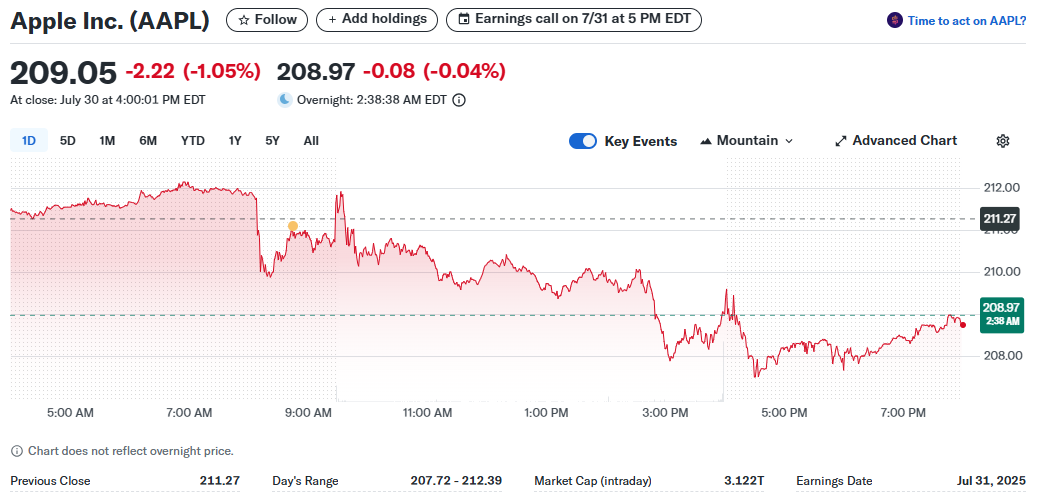

Apple Inc. (NASDAQ: AAPL) shares closed at $209.05, down 1.05%, on Tuesday ahead of the company’s anticipated third-quarter earnings report.

Despite optimistic projections from analysts, who expect a 4.2% revenue increase to $89.3 billion for the April-June 2025 period, investors remain cautious amid geopolitical and technological headwinds.

Analysts estimate earnings per share (EPS) at $1.43, representing a 1.8% year-over-year growth, according to Nasdaq. Yet, uncertainty surrounding Apple’s AI strategy, exposure to U.S.-China trade tensions, and slowing momentum in certain hardware segments seem to be keeping sentiment subdued.

iPhone Sales Get China Boost as Other Devices Lag

Contents

While Apple faces external pressures, its flagship iPhone line remains resilient. Counterpoint Research reports a 2.2% year-over-year increase in iPhone sales in Q3, driven largely by an 8% surge in Chinese demand, amplified by the popular 618 shopping festival.

This performance was strong enough to help offset tepid performance in other hardware categories such as iPads and Macs.

However, Apple’s non-iPhone device sales are projected to slow, a sign that the company’s broader hardware ecosystem may be hitting saturation in key markets. In contrast, Apple’s services division continues to shine, with revenue from services expected to make up 10.7% of total income, reflecting growing consumer reliance on Apple’s digital ecosystem.

Tariffs Loom, but Supply Chain Shift Eases Impact

A key concern for investors has been the impact of U.S. tariffs on Apple’s bottom line. However, analysts estimate the hit may be less than $900 million, significantly lower than earlier fears.

Apple’s strategic move to shift a significant portion of iPhone production to India appears to be mitigating the blow.

More than 50% of U.S.-bound iPhones are now assembled in India, contributing to a 240% rise in Indian-made smartphone exports in Q2 2025. Apple’s dual strategy of keeping Chinese manufacturing for global markets while localizing U.S. production may offer a long-term hedge against geopolitical risks.

AI Hesitation Raises Red Flags

Though Apple’s financials remain solid, its slow rollout of AI features has raised red flags among analysts. Competitors like Google and Microsoft have accelerated AI integration across their ecosystems, leaving Apple lagging behind in a rapidly evolving tech landscape.

Apple’s cautious approach could hurt its competitiveness, especially as consumers and developers increasingly prioritize AI-enabled experiences. The company’s upcoming product announcements will be closely watched for signs of meaningful AI integration.

With earnings set to drop after the bell today, investors and analysts alike are bracing for more than just numbers, they’re looking for clarity on how Apple plans to navigate AI innovation and ongoing geopolitical challenges.