TLDRs;

- Broadcom forecasts $17.4B Q4 sales, beating estimates as AI chip demand accelerates across hyperscale data centers.

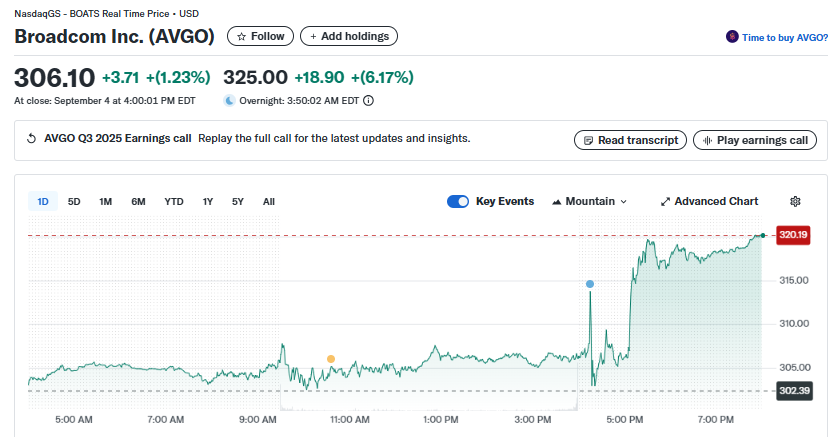

- Shares jump 6% overnight, with AVGO stock up 32% year-to-date amid strong AI-driven semiconductor momentum.

- AI chip revenue to surge 63% in Q4, fueled by $10B in new orders and rising demand for custom ASICs.

- Industry-wide AI investments topping $155B in 2025 benefit Broadcom, expanding opportunities beyond Nvidia and GPU suppliers.

Broadcom Inc. (NASDAQ: AVGO) saw its stock surge over 6% in overnight trading after the company projected stronger-than-expected fourth-quarter results, fueled by booming demand for artificial intelligence (AI) chips and networking equipment.

The California-based semiconductor firm now expects Q4 sales to reach $17.4 billion, surpassing the Wall Street consensus estimate of $17.1 billion, according to Bloomberg.

Shares of Broadcom climbed to $325 in extended trading, representing a year-to-date gain of 32% in 2025. The upbeat forecast highlights how companies beyond traditional GPU makers, such as Nvidia, are capturing a larger share of the AI infrastructure boom.

Custom Chips Drive Revenue Surge

A key growth driver for Broadcom is its custom application-specific integrated circuits (ASICs), which have emerged as preferred solutions for hyperscale customers like Alphabet and Apple.

Unlike off-the-shelf GPUs, Broadcom’s chips can be optimized for specialized workloads, offering improved efficiency in running large-scale AI models.

The company disclosed that it has secured over $10 billion in new AI infrastructure orders from a major client, pushing its AI semiconductor revenue forecast for Q4 to $6.2 billion, a 63% jump from the previous quarter. AI now represents 29% of Broadcom’s total revenue, underscoring the speed at which the technology has reshaped its business model.

$AVGO | Broadcom is -0.2% after-hours.

🔹 EPS: $1.69 vs. $1.66 est. ✅

🔹 Revenue: $15.95B vs. $15.83B est. ✅Key takeaways:

🔸 Semiconductor rev: +26% YoY

🔸 Infrastructure rev: +43% YoY

🔸 AI rev: +63% YoY

🔸 Q4 revenue outlook: $17.4B (+24% YoY)

🔸 Q4 EBITDA outlook: ~67% pic.twitter.com/sSMDxLDeOz— CMG Venture Group (@CmgVenture) September 4, 2025

Beyond Nvidia’s Shadow

Broadcom’s bullish forecast contrasts sharply with Nvidia’s recent revenue guidance, which fell short of investor expectations. While Nvidia remains the dominant supplier of GPUs for AI, Broadcom’s success demonstrates that hyperscale firms are diversifying their hardware choices.

Many are now commissioning tailored chips designed to enhance data center performance and reduce reliance on general-purpose processors.

This shift reflects a broader industry trend. Big Tech players, Meta, Amazon, Microsoft, and Alphabet, are collectively expected to spend $155 billion on AI infrastructure in 2025, according to analysts. This spending benefits not only GPU vendors but also networking suppliers and custom chipmakers like Broadcom.

Long-Term Growth Opportunities

Broadcom’s strong quarter builds on earlier momentum in 2025, when its Q3 sales rose 22% to nearly $16 billion. Analysts suggest that as AI adoption matures, the semiconductor supply chain will continue to expand, creating growth opportunities across multiple segments.

Despite reports that 95% of U.S. businesses have yet to realize meaningful productivity gains from generative AI, corporate spending shows no sign of slowing. Instead, enterprises are laying the foundation for long-term AI deployment, driving demand for chips, servers, and networking products.

For Broadcom, this environment positions it as a critical enabler of AI infrastructure. With a combination of custom semiconductors, networking solutions, and high-value design expertise, the company is becoming indispensable to hyperscale firms seeking to optimize AI performance at scale.