TLDRs;

- BYD stock dropped 5.24% in Hong Kong after reporting a 30% decline in Q2 profit despite rising revenue.

- Aggressive price cuts and higher advertising spend in China have squeezed BYD’s margins and raised financial pressures.

- Analysts warn China’s EV industry could shrink by 88% by 2030 due to unsustainable competition and falling prices.

- BYD’s international sales jumped nearly 145% in Q2, providing a crucial cushion as domestic profitability falters.

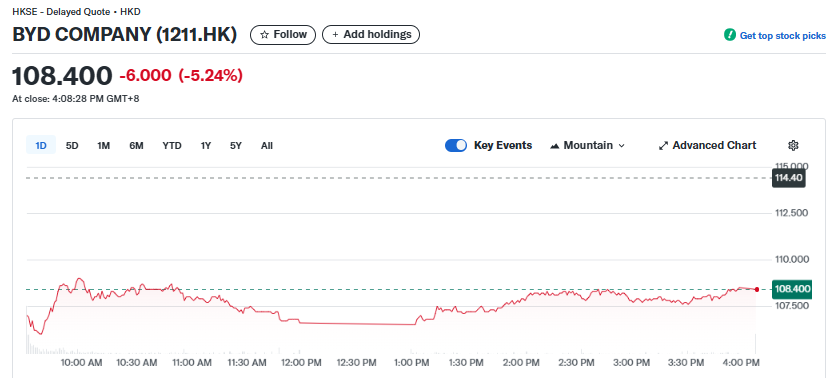

Shares of BYD (1211.HK) slid 5.24% in Hong Kong trading on September 1, 2025, after the Chinese electric vehicle (EV) giant reported a sharp drop in quarterly earnings.

The company’s net profit for the June quarter tumbled 30% year-on-year to 6.4 billion yuan (US$891 million), according to LSEG data.

While revenues climbed 14% to 201 billion yuan (US$28 billion), rising sales were not enough to offset shrinking margins and heavy domestic competition.

China’s Fierce EV Price War

The steep decline in profitability underscores the brutal price war that has engulfed China’s EV industry. A Nomura report highlighted that average car retail prices in the country have fallen by 19% over the past two years, now averaging 165,000 yuan (US$22,900).

BYD itself has slashed prices by as much as 34% across its popular model lineup to maintain market share.

This aggressive discounting has tightened margins across the industry, with BYD’s gross margin contracting to 16.3% in Q2, even as its debt-to-asset ratio rose to 71.1%.

BYD reported H1 25 Earnings this week:

—Revenue: +23.3% to RMB371.3B

—Gross profit: +18.2% to RMB66.9B

—Profit to owners: +13.8% to RMB15.5B

—Earnings per share: +9.6% to RMB1.71"New energy vehicle sales hit another record high…" pic.twitter.com/mdPOcjuLHD

— The Transcript (@TheTranscript_) August 31, 2025

The Chinese government has publicly criticized the trend as “rat-race competition,” warning that the relentless undercutting is unsustainable and could trigger large-scale consolidation.

Industry Shakeout Looms

Analysts predict that only about 15 of China’s current 129 EV manufacturers will survive the next decade, with roughly 88% of brands likely to collapse or be absorbed by larger players.

This projection mirrors past patterns in other capital-intensive industries, where aggressive competition eliminated weaker firms, leaving only those with scale, efficiency, and diversified revenue streams.

For BYD, the squeeze is particularly significant. Despite being the market leader and a key rival to Tesla in China, it is not immune to the financial strain caused by the price war. If industry leaders like BYD are forced to operate with razor-thin margins, smaller competitors face even bleaker odds of survival.

Global Expansion as Lifeline

While domestic profitability suffers, BYD’s international expansion has emerged as a crucial buffer. Overseas sales of new energy vehicles (NEVs) surged 144.7% year-on-year in Q2, with 258,182 units shipped abroad.

This rapid international growth helped offset the profit hit at home, giving BYD a broader revenue base to weather China’s cutthroat market dynamics.

The strategy highlights a stark contrast. BYD maintains pricing power in overseas markets while cutting prices aggressively in China. This geographic diversification could position the company advantageously when consolidation reshapes the domestic EV landscape. Should weaker rivals collapse, BYD could emerge from the turmoil stronger, supported by both international growth and a streamlined home market.