TLDRs;

Contents

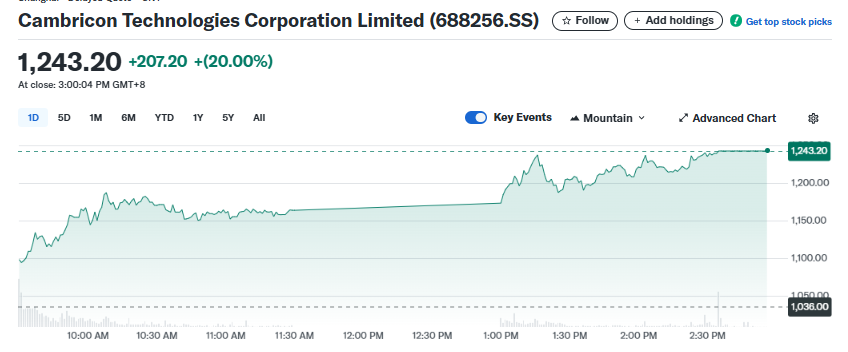

- Cambricon stock jumped 20% after Nvidia halted H20 chip production, sparking optimism for Chinese AI chipmakers.

- The rally lifted Cambricon’s six-week gains to 125%, making it the best-performing stock on the CSI 300.

- Other Chinese chipmakers also surged, Hua Hong up 13% and Hygon up 19%, highlighting broad sector momentum.

- Government policy and funding continue to shape China’s semiconductor rise, overriding traditional market dynamics.

Cambricon Technologies, a leading Chinese AI chipmaker, saw its stock price soar 20% on August 22, 2025, after reports emerged that Nvidia had asked suppliers to halt production of its H20 chips.

The unexpected move ignited a wave of investor confidence in Chinese semiconductor firms, positioning Cambricon as a key beneficiary of rising geopolitical tensions in the global chip industry.

The surge comes as Cambricon’s stock has already been on a historic run, climbing more than 125% since July 10, 2025. This performance has made the company the top gainer on the CSI 300 index over the past six weeks, signaling a dramatic shift in investor sentiment toward domestic AI chip suppliers.

Domestic Chipmakers Gain Investor Attention

The impact of Nvidia’s supply halt was not limited to Cambricon. Other Chinese semiconductor firms also rode the wave of investor optimism. Hua Hong Semiconductor saw its shares rise 13%, while Hygon Information Technology surged nearly 19% on the same day.

Analysts suggest that this trend reflects more than a short-term rally. With the U.S. tightening restrictions on advanced chip exports to China, local chipmakers are increasingly being viewed as viable alternatives.

Beijing has also reportedly encouraged domestic firms to avoid reliance on Nvidia’s H20 chips, further accelerating the market’s pivot toward homegrown solutions. This combination of policy directives and geopolitical friction has created fertile ground for Chinese firms to thrive.

Policy Backing Drives Market Shift

China’s semiconductor sector is heavily supported by government investment and policy directives. Despite lagging behind global leaders in advanced chip manufacturing nodes state-backed funding has allowed companies like Cambricon to expand aggressively.

🇨🇳Cambricon Technologies Corp., China’s best-performing stock in 2024, has more than doubled from a July low as momentum builds around the country’s push for semiconductor self-sufficiency.

Shares of Cambricon, the AI chip maker, soared as much as 20% on Friday, fueled by a… https://t.co/f1gR33n5mT pic.twitter.com/wXaUKiA5Wf— CN Wire (@Sino_Market) August 22, 2025

In July, Cambricon successfully raised $557 million to develop a new large-model chip platform, underscoring both investor confidence and government backing. Meanwhile, the rise of domestic AI models, such as DeepSeek, has increased demand for local semiconductor solutions that can power next-generation artificial intelligence applications.

The billions of dollars invested by Beijing into its semiconductor ecosystem suggest that traditional market forces are being supplemented, if not replaced, by strategic industrial policy. For Cambricon, this means competing not purely on performance metrics but also on access to market share fostered by government support.

A New Competitive Landscape

The unfolding events highlight how quickly the competitive balance in global technology can shift. Nvidia’s temporary production halt may be a blip in its broader dominance, but for Cambricon and other Chinese firms, it represents a critical opening.

As investors recalibrate their strategies around the growing role of government policy in shaping technology markets, firms like Cambricon are positioned to benefit regardless of whether their chips match Western capabilities in raw performance.