TLDRs:

Contents

- China urges EV makers to scale back amid fears of economic deflation and overcapacity.

- Officials warn of “involution” as overinvestment drains profitability across key sectors like EVs.

- Price slashing by BYD, Great Wall Motors among signs of a worsening price war.

- EU tariffs push Chinese EV makers to shift focus to hybrid cars and maintain European market share.

China has issued a strong warning to its booming electric vehicle (EV) industry, urging automakers to halt aggressive price cuts and rein in production, as mounting overcapacity threatens to spiral into long-term economic instability.

The warning follows a high-level meeting between leading EV manufacturers, including BYD and Great Wall Motors, and Chinese regulators, who flagged growing concern over what officials described as “involution”, a destructive cycle of overinvestment that yields shrinking returns.

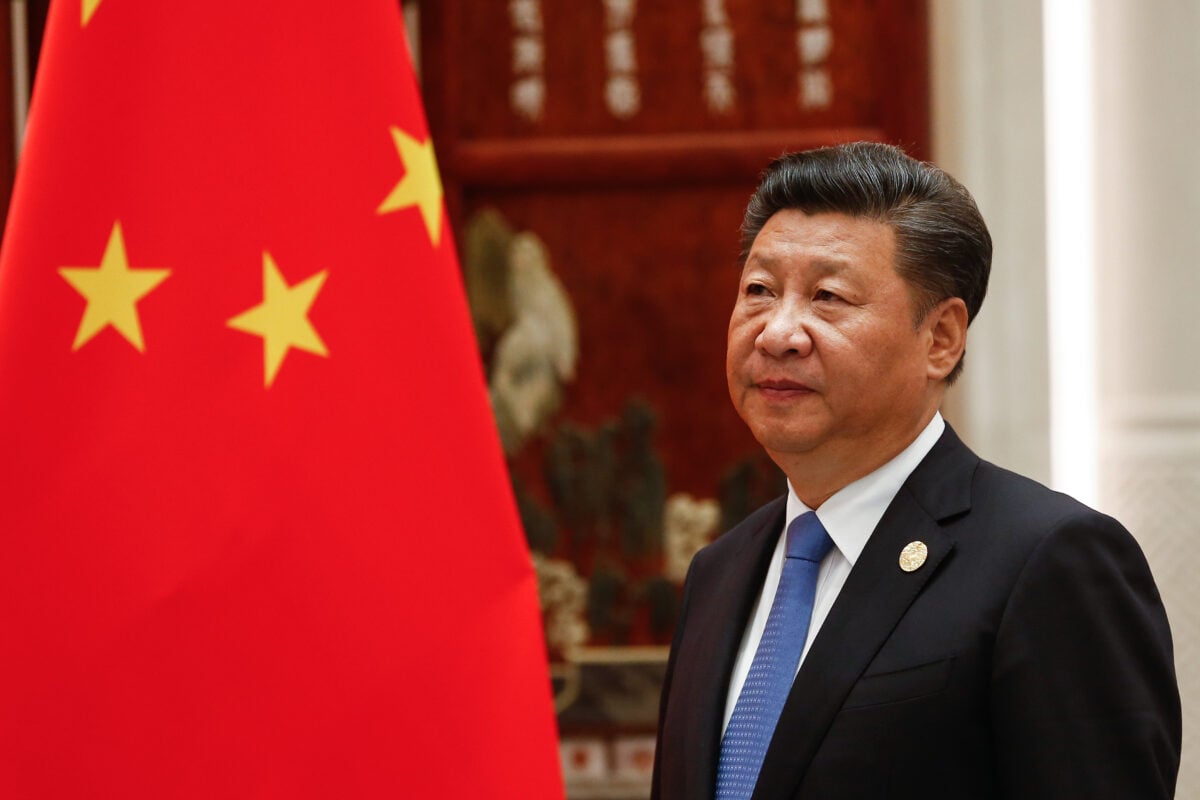

President Xi Jinping has also weighed in, criticizing provincial governments for fueling this trend through excessive subsidies and industrial overreach. The call for restraint comes as China faces broader economic pressures, including slowing growth and deflationary risks.

Price Wars Erode Margins as Brands Race to the Bottom

The intense competition has sparked a race to slash prices among Chinese EV makers. BYD’s Seagull model is now being sold nearly 20% below its official retail price, while Great Wall Motors has lowered prices on its Ora 3 to maintain market share.

Though the price drops have excited consumers in the short term, industry analysts warn that most EV companies remain unprofitable. Many are propped up by local government incentives, which are increasingly at odds with Beijing’s national economic strategy.

To counter these market distortions, China is proposing amendments to its pricing law to strengthen regulatory oversight and prevent “irrational competition,” suggesting a possible shift toward centralized pricing controls in the future.

Subsidies Sparked EV Boom, But Now Pose Systemic Risk

China’s current EV woes are rooted in a decade-long subsidy program that pumped over $230 billion into the sector, leading to inflated supply and artificially stimulated demand.

At its peak, China hosted more than 200 EV brands offering over 300 different models, a number that has since contributed to market fragmentation. Surveys now indicate that 62% of companies in the automotive sector are grappling with overcapacity, a figure that reflects deep structural imbalances.

Complicating matters, 44% of Chinese EV buyers say they would not purchase another EV without government incentives, revealing how fragile the demand side remains without state support.

Local Government Support Conflicts with Central Crackdown

Efforts to rein in production face resistance from local governments, many of which maintain direct stakes in EV companies as a means to sustain regional employment and growth.

Analysts warn that this tug-of-war between central and local interests could stymie Beijing’s push for reform.

“Many EV firms are tightly woven into local economies. Local officials won’t let them fail easily.”Antonia Hmaidi of the Mercator Institute noted.

With Europe imposing tariffs of up to 45% on Chinese EV imports, some manufacturers have pivoted to hybrid models to skirt penalties. These hybrids helped China regain 10% of Europe’s EV market share in June, demonstrating the adaptability, but also the desperation, within the industry.