TLDRs:

Contents

- Chinese robotics companies are pricing humanoid robots aggressively below global averages to capture market share.

- AI technology still limits humanoid robots’ practical applications despite mechanical advances.

- China leads the world in robotics patents and production amid strategic government support.

- The industry bets on imminent AI breakthroughs to unlock humanoid robots’ full potential.

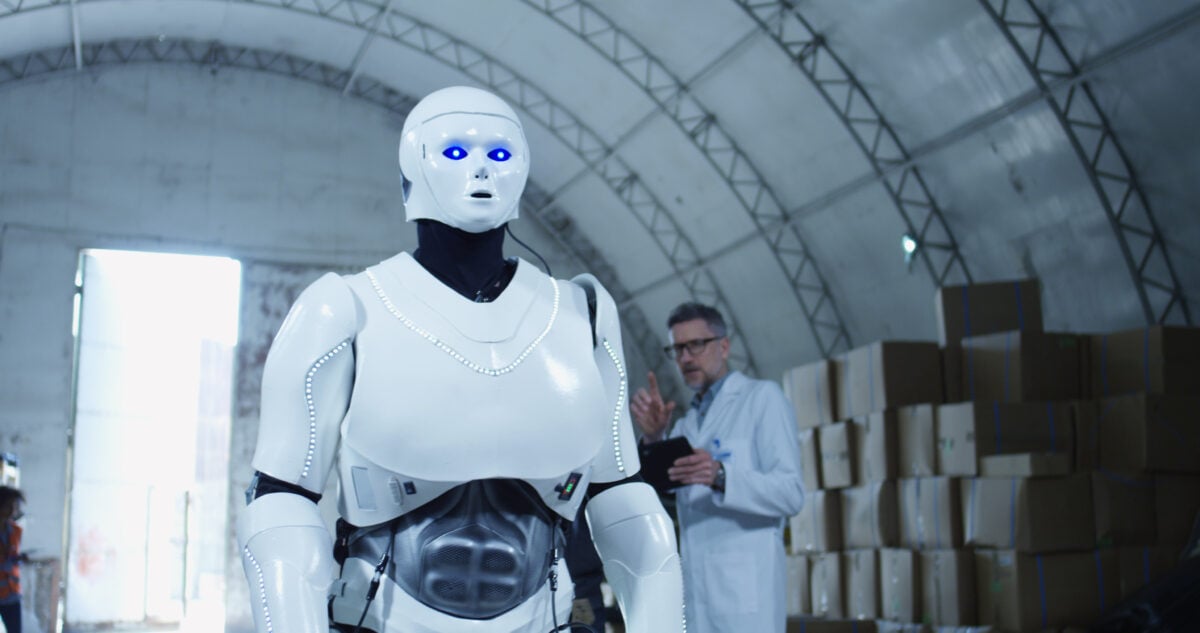

Chinese robotics firms are boldly slashing prices on humanoid robots in an effort to secure a foothold in a growing global market, even though the AI technology needed to fully realize their potential remains immature.

Wang Xingxing, CEO of Hangzhou-based Unitree Robotics, recently told the World Robots Conference in Beijing that while hardware advances have been impressive, AI models still need one to three years to catch up for mainstream adoption.

Unitree’s latest R1 humanoid robot retails at approximately $5,900, a steep departure from the $200,000 price tag typical of high-income countries’ robots today. Industry projections estimate prices will drop to about $50,000 by 2050 in developed markets.

Yet Chinese companies like Unitree and Shenzhen-based Engine AI are already selling robots well below $6,000, signaling a strategy focused on volume and market entry rather than short-term profits.

China’s Robotics Surge Fueled by Strategic Policy and Innovation

This aggressive pricing strategy is consistent with China’s broader manufacturing approach and government-backed robotics initiatives. Since launching the “Made in China 2025” plan nearly a decade ago, the country has rapidly expanded its robotics ecosystem.

Data from the National Bureau of Statistics shows a 35.6% year-on-year increase in industrial robot production in H1 2025 alone, totaling over 369,000 units.

China now accounts for more than half of global industrial robot installations, with its robot density surpassing major economies like Germany and Japan. The state plays a pivotal role by providing funding, R&D support, and large-scale procurement orders, such as the 124 million yuan deal from China Mobile, driving both supply and demand.

Mechanical Progress Meets AI Challenges in Real-World Tests

Despite strides in mechanical engineering, practical application of humanoid robots remains constrained by AI limitations. Recent public demonstrations, including Chinese robots participating in half-marathons and football matches, revealed many stumbling or failing to complete tasks.

This highlights the current gap between hardware capabilities and the sophisticated AI intelligence necessary for real-world autonomy.

Wang compares the industry’s status to the pre-ChatGPT era of AI, where hardware often outpaces software development. The industry is essentially laying a hardware foundation today, anticipating AI breakthroughs within the next few years that will enable robots to perform complex tasks more reliably.

Economic and Demographic Imperatives Drive Robotics Demand

The push for humanoid robots also aligns with China’s demographic challenges, such as an aging population and shrinking workforce, which threaten manufacturing productivity.

Automation through robotics is thus seen not only as a technological innovation but as an economic necessity.

Market estimates predict the global humanoid robot market could expand from $4 billion in 2030 to over $38 billion by 2035, with China well positioned to lead this growth. Companies like Unitree are targeting sectors from manufacturing to healthcare and education, showcasing their robots at cultural events and generating revenues exceeding $139 million annually.