TLDRs;

Contents

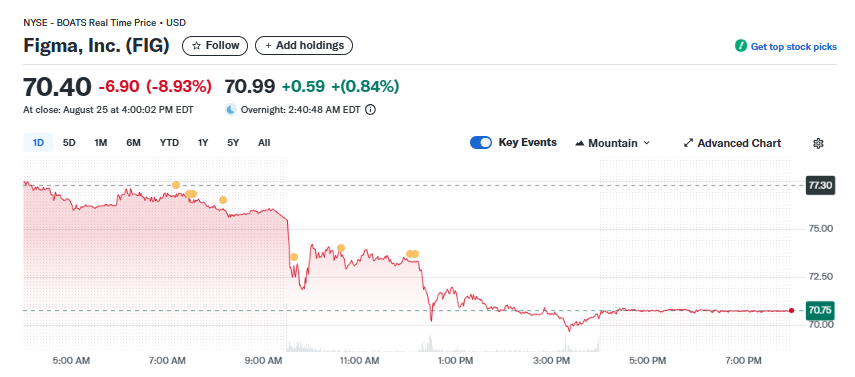

- Figma stock dropped nearly 9% to close at $70.40, raising concerns over stretched valuations after its IPO surge.

- Shares previously rocketed to $120 but have since fallen as analysts highlight slowing growth opportunities.

- Figma boasts $821M revenue, 46% growth, and 91% margins, but expansion beyond current clients will be crucial.

- Investors may benefit from waiting until management outlines long-term growth strategy on September 3.

Figma (NYSE: FIG) saw its stock price tumble nearly 9% on Monday, closing at $70.40, as analysts warned the design software company may be trading at an unsustainable premium.

The sharp decline comes just weeks after a blockbuster initial public offering (IPO) that briefly sent shares soaring above $120 on heavy demand.

The sudden reversal in momentum has left many retail investors questioning whether the stock’s current valuation is justified, or if patience is the wiser strategy until the dust settles.

From IPO Euphoria to Market Reality

When Figma made its Wall Street debut, shares priced at $33 quickly skyrocketed to over $120 by the second day of trading, fueled by excitement over its collaborative design platform.

However, the rally proved short-lived. With Monday’s nearly 9% drop, the stock now trades around $70, leaving many late entrants nursing steep losses.

Analysts suggest that the sell-off reflects a broader reassessment of whether Figma’s growth trajectory can support such lofty valuations. Trading at nearly 35 times sales, the stock is far more expensive than many of its software peers, even those with similarly rapid growth.

Strong Financials, But Growth Headwinds Ahead

On paper, Figma’s financial performance is impressive. Over the last 12 months, the company generated $821 million in revenue, up 46% year-over-year, while maintaining a staggering 91% gross margin. These metrics highlight the platform’s profitability potential once it scales further.

However, concerns remain over market saturation. According to its IPO filings, 78% of Forbes 2000 companies already use Figma, leaving only 22% of large enterprises untapped. This raises the question of how much headroom is left for expansion in its core market. To sustain growth, analysts argue Figma will need to diversify its product offerings and deepen monetization within existing accounts.

Investor Outlook: Patience Over Hype

Despite its stellar adoption and growth metrics, many analysts advise investors to tread carefully. Figma’s premium valuation makes it vulnerable to volatility, especially if growth slows or management fails to present a clear expansion strategy.

$FIG hype is fizzling out after an explosive run, now sitting up 135% from its IPO. The stock has repeatedly tested support, showing signs of weakening momentum. If that floor gives way, downside pressure could accelerate.

A breakdown below $76 opens risk toward $70, then… pic.twitter.com/ajM1VK8dNE

— Hulk (@HulkCapital) August 18, 2025

Adobe’s failed $20 billion acquisition attempt in 2022 underscores both the strategic value and regulatory risks surrounding the company. With competitors circling and the easy growth phase largely behind it, the next stage will require innovation beyond its flagship design tools.

Management is expected to provide more clarity during its first earnings call on September 3, where investors hope to hear detailed plans for future product rollouts and growth drivers. Until then, some market watchers believe the stock could remain driven more by speculation than fundamentals.