TLDRs:

Contents

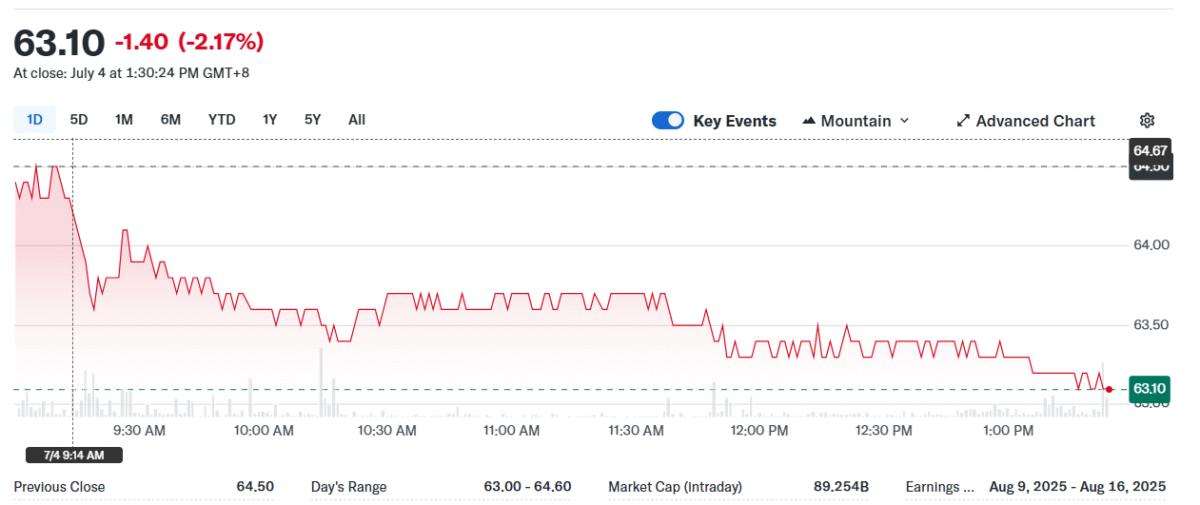

- Foxconn stock dropped to NT$63.10 despite a strong 15.8 percent surge in Q2 sales driven by AI and iPhone demand.

- Revenue reached NT$1.8 trillion for the quarter ending June, with Apple and Nvidia-related products as key growth engines.

- Geopolitical tensions and new U.S. tariffs are pushing Foxconn to diversify its manufacturing footprint.

- Chairman Young Liu projects up to NT$8 trillion in annual revenue, emphasizing long-term confidence despite short-term market jitters.

Foxconn Technology Co., Ltd. saw its stock price dip to NT$63.10 on July 4, shedding 2.17 percent in a single trading session, even after the company reported a solid quarterly performance fueled by booming AI server orders and strong iPhone demand.

The drop came despite a 15.8 percent year-on-year surge in revenue for the quarter ending June, signaling investor caution amid ongoing geopolitical and supply chain challenges.

AI and Apple sales power record-breaking quarter

Hon Hai Precision Industry Co., the parent company of Foxconn Technology, revealed that revenue for the second quarter climbed to NT$1.8 trillion, or approximately US$62 billion.

The increase was largely attributed to two major growth pillars: Apple’s continued dominance in the smartphone market and rising demand for AI servers powered by Nvidia chips. Foxconn remains a primary supplier for both Apple and several major cloud service providers, placing it at the heart of the global AI and consumer electronics boom.

China’s appetite for iPhones boosts shipments

According to market research firm Counterpoint, Apple smartphone sales in China grew by 8 percent during the second quarter, largely thanks to the popularity of the iPhone 16 Pro and Pro Max models.

This trend played a critical role in lifting Foxconn’s overall shipments, particularly during China’s June 18 online shopping festival. In May alone, Foxconn reported monthly revenue of NT$615.75 billion (US$20.6 billion), an 11.92 percent increase from the same month in 2024.

Geopolitical pressures weigh on market sentiment

Despite robust sales figures and a clear path to further growth, Foxconn’s market valuation took a hit. Analysts point to mounting geopolitical tensions and shifting global trade dynamics as potential overhangs on the stock.

The U.S. has proposed steep tariffs on goods produced in or transshipped through Vietnam, a country where Foxconn has sizable operations. These developments are forcing the company to rethink its manufacturing strategy and accelerate diversification beyond China and Southeast Asia.

The firm has already lowered its full-year revenue guidance once this year, citing uncertainty tied to international trade policy. Chairman Young Liu has hinted at possible new manufacturing partnerships in the U.S., signaling a readiness to adapt operations to geopolitical realities.

Diversified portfolio offers resilience in turbulent times

While the stock’s short-term performance may reflect investor anxiety, Foxconn’s business fundamentals remain strong. The company’s dual focus on AI infrastructure and consumer electronics creates two complementary revenue streams, helping to cushion the blow of sector-specific slowdowns.

iPhone sales tend to fluctuate seasonally, but AI server demand, driven by enterprise and cloud capital expenditure, offers longer-term growth stability.

From January to May 2025, Foxconn posted a consolidated revenue of NT$2.899 trillion (US$96.9 billion), marking a 21.65 percent increase compared to the same period last year. With forecasts pointing to continued growth in the third quarter, both sequentially and year-over-year, Foxconn remains a critical player in the global technology supply chain.