TLDR

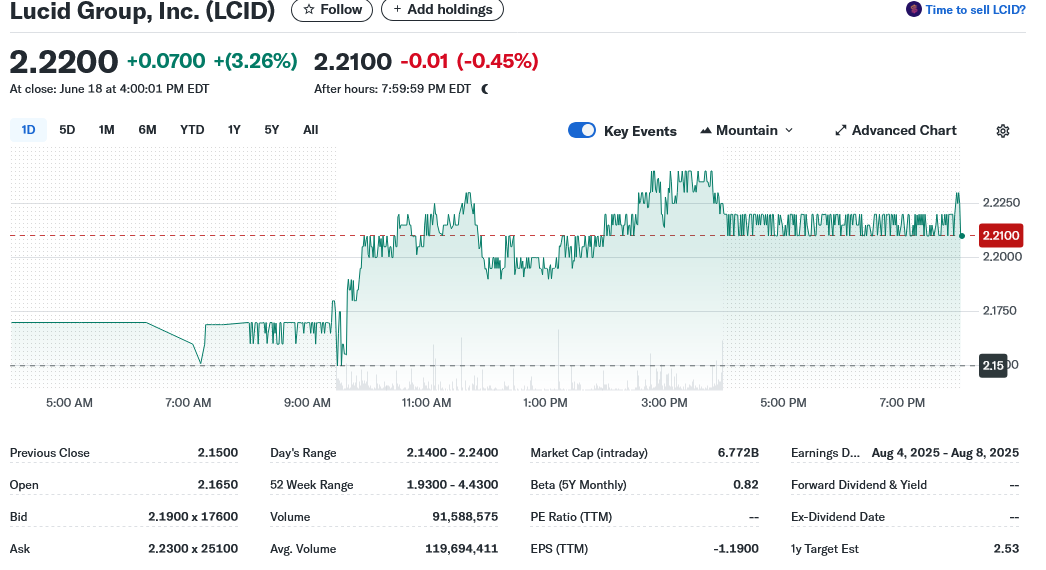

- Lucid Group (NASDAQ:LCID) stock traded up 3% to $2.22 on Wednesday with 26.7 million shares changing hands

- Analysts maintain mixed ratings with average price target of $2.68, ranging from $1.13 to $5.00

- Company reported Q1 revenue of $235 million, missing estimates, with deliveries up 58% to 3,109 vehicles

- Gross margins remain negative while competitors Tesla and Rivian achieved positive margins

- Share count increased 30% over past year due to dilution, with plans to double production to 20,000 vehicles in 2025

Lucid Group shares climbed 3% during Wednesday’s session, reaching $2.22 as the electric vehicle maker continues its push toward profitability. The stock saw reduced volume with 26.7 million shares traded, down 75% from the typical 107 million share average.

The trading action comes as analysts remain divided on the company’s prospects. Cantor Fitzgerald maintains a neutral rating with a $3.00 price target, while Morgan Stanley upgraded from underweight to equal weight in March.

Benchmark keeps a buy rating with a $5.00 target, but Redburn Atlantic cut the stock to sell with a $1.13 price objective. The consensus rating sits at hold with an average target of $2.68.

Financial Performance Lags Expectations

Lucid’s first quarter results showed mixed signals for investors. Revenue reached $235 million, falling short of the $250.5 million analyst estimate. The company delivered 3,109 vehicles, representing a 58% jump from the prior year quarter.

The earnings per share loss of $0.24 exceeded analyst expectations by one cent. This miss highlights ongoing profitability challenges as the company scales production.

The revenue growth of 36% year-over-year demonstrates expanding sales momentum. However, the company maintains a negative gross margin of 275.73%, contrasting sharply with competitors.

Tesla and Rivian have both achieved positive gross margins recently. Rivian accomplished this feat without models priced under $50,000, showing the potential for luxury EV profitability.

Lucid’s margin struggles force continued reliance on external funding. The company has raised debt from major investors while also diluting shareholders.

Share count increased roughly 30% over the past year to address financing needs. This dilution pressures existing shareholders as the company burns cash.

Production Expansion Plans Take Shape

Management plans to double vehicle production from last year’s levels. The target calls for approximately 20,000 vehicles produced by 2025.

The new Gravity SUV represents a key growth driver with its $80,000 starting price. This model marks Lucid’s entry into the popular SUV segment, which dominates U.S. vehicle sales.

The Gravity shares components with the Air sedan, potentially creating manufacturing efficiencies. A midsize SUV called the Lucid Earth is planned for 2026 or 2027 with a rumored $48,000 starting price.

Current vehicle pricing remains a challenge for mass market adoption. The lowest-priced Air sedan costs 43% more than the average new vehicle transaction price.

Consumer interest in electric vehicles has declined from 23% in 2023 to 16% currently according to AAA data. This trend creates headwinds for all EV manufacturers, particularly luxury-focused brands.

The company maintains strong liquidity metrics with a current ratio of 3.32 and quick ratio of 2.97. The debt-to-equity ratio stands at 0.65, indicating manageable leverage levels.

Institutional ownership reached 75.17% of outstanding shares. Several major investors increased positions during the first quarter, including BI Asset Management and Sei Investments.

Saudi Arabia’s Public Investment Fund remains a key backer, providing funding stability. However, minority shareholders face dilution risk if margins don’t improve and additional capital raises become necessary.

Current automotive tariffs could pressure gross margins by 8% to 15% according to management guidance. The company traded at $2.22 with a market capitalization of $6.82 billion and maintains analyst expectations for full-year losses of $1.25 per share.