TLDR;

Contents

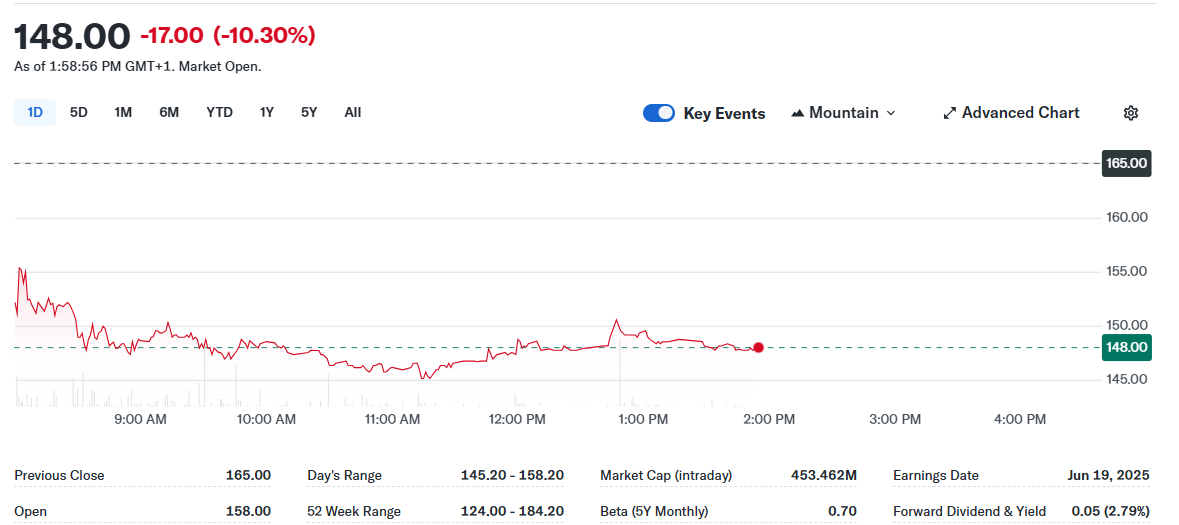

- NCC Group shares fell sharply by 10.3% to 148.00p as core cybersecurity revenues disappointed investors.

- Pre-tax profit rose to £16.6 million, largely due to a £65.6 million asset sale rather than operational improvements.

- The Escode software escrow unit continues to grow, but its potential sale adds strategic uncertainty.

- Executives bought shares to show confidence, but the market remains cautious amid poor trading momentum.

NCC Group’s shares plunged over 10% on Thursday, erasing recent gains and rattling investor confidence after the company’s core cybersecurity business showed fresh signs of strain.

The sharp drop, which sent the stock tumbling to 148.00p, marked a 17.00p fall from the previous close of 165.00p, underscoring deep concerns about the sustainability of recent profit figures.

Profits Surge but Fail to Mask Operational Declines

NCC Group reported that pre-tax profit for the six months ending March 31 more than doubled to £16.6 million, buoyed by the one-off sale of its Fox Crypto business for £65.6 million. However, underlying performance painted a less optimistic picture. Adjusted EBITDA dropped to £21.5 million, down from £25.5 million a year earlier, as delays in closing larger cybersecurity deals weighed heavily on results.

The firm said it is intentionally moving away from low-margin compliance contracts to focus on high-value managed security services and identity management solutions. But that transition appears to be happening slower than expected, with Cyber Security division revenue declining by 6.6% on a constant currency basis.

Escode Unit Grows, but Strategic Uncertainty Lingers

NCC’s software escrow business, Escode, delivered its tenth consecutive quarter of growth, offering a rare silver lining. The company confirmed that a sale of Escode is under consideration, with discussions ongoing. Management suggested that any resulting deal could lead to a capital return to shareholders, but market reaction suggests investors remain unconvinced without a clearer roadmap for the core cybersecurity business.

Even with the asset sale, NCC’s market cap stood at £453.46 million by mid-afternoon Thursday, reflecting declining investor appetite. The interim dividend was held steady at 1.50p per share, but that did little to stop the bleeding.

Stock Performance Cracks Despite Executive Confidence

On the technical side, Thursday’s price action was troubling. The stock opened at 158.00p but quickly lost ground, hitting an intraday low of 145.20p before settling at 148.00p by 1:58 PM. That represents a 10.30% drop, making it one of the worst single-day performances for the company in recent quarters.

Interestingly, the decline came just days after top NCC executives, including the CEO, CFO, and CMO, increased their holdings through a UK Share Incentive Plan. This show of internal confidence has done little to reassure markets in the face of poor revenue performance and a shifting strategy.

Mixed Analyst Views as Trading Interest Rises

While open interest in NCC Ltd surged by over 24%, signaling heightened trading activity, delivery volumes have declined, suggesting waning conviction among long-term investors. Analysts are split on the stock. TipRanks’ Spark tool gives it a “Neutral” score, citing strong internal sentiment and momentum but flagging concerns around valuation and negative earnings metrics.

For now, NCC stands at a crossroads. Its near-term financial health looks temporarily improved by asset sales, but the market is clearly demanding proof that its core business can deliver sustained growth without one-off gains.