TLDRs:

Contents

- Nokia stock fell nearly 4% after disappointing Q2 earnings missed analyst expectations.

- CEO Justin Hotard warns of forex risks but expects stronger H2 performance.

- Profit drop driven by weak dollar and new tariffs impacting Nokia’s global operations.

- Nokia leans into AI and defense investments to rebound from telecom headwinds.

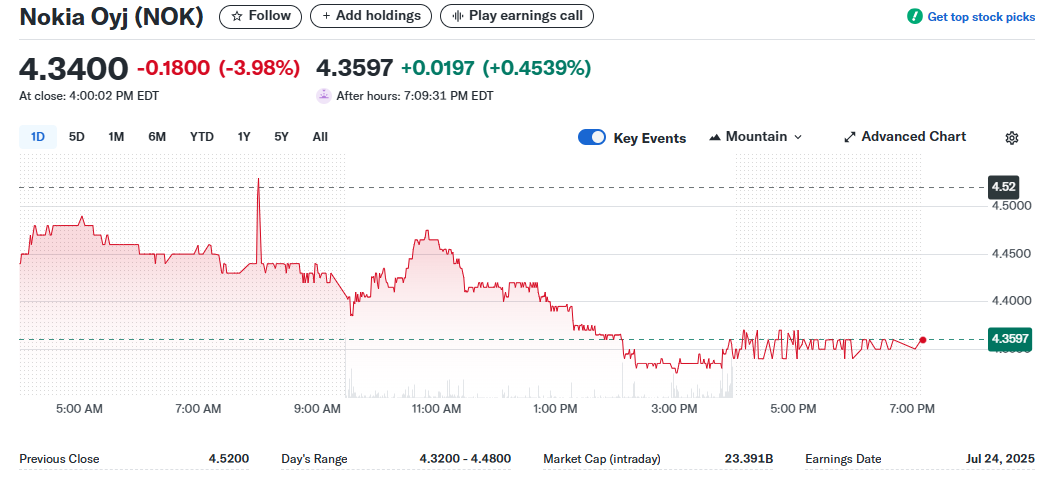

Nokia Oyj (NYSE: NOK) saw its stock slide nearly 4% on Thursday, after the Finnish telecom giant reported weaker-than-expected Q2 earnings and revised its full-year profit guidance downward.

The company’s stock closed at $4.34, down 3.98%, after dropping as much as 7.6% the day before when the profit warning was first issued.

The stock did show slight signs of recovery in after-hours trading, inching up 0.45% to $4.36. However, the market’s immediate reaction highlighted investor concern around Nokia’s exposure to currency fluctuations and new international tariffs.

Profit Declines Despite Modest Revenue Growth

Nokia confirmed its preliminary second-quarter results, posting revenue of €4.55 billion (US$5.5 billion), representing only marginal year-over-year growth. However, the company’s operating profit fell 29% to €301 million (US$361.2 million), far below the analyst consensus estimate of €402 million (US$482.4 million) according to data from Infront.

The shortfall was mainly attributed to a €60 million hit from currency revaluation and €20–30 million in tariffs. CEO Justin Hotard explained that for every 1-cent shift in the euro-dollar exchange rate, Nokia could lose €10–15 million in earnings, a critical concern given the U.S. dollar’s ongoing weakness.

CEO Projects Recovery with AI and Defense Pivot

Despite the bleak earnings, Hotard struck a cautiously optimistic tone. He stated that Nokia is targeting a stronger second half of 2025, driven by strategic shifts toward connectivity infrastructure, AI, and national defense applications.

“We’re simplifying operations and investing in future-ready technologies,” said Hotard, who took the helm in April after previously leading Intel’s AI and data center business. “AI-powered connectivity and rising defense budgets from NATO members provide new growth opportunities.”

He specifically cited NATO’s increased defense spending target of 5% of GDP as a tailwind for Nokia’s expansion into secure communications and military-grade network infrastructure.

Legacy Mobile Giant Grapples with Market Evolution

A decade ago, Nokia exited the consumer mobile phone space to focus on telecom infrastructure, a move that once reinvigorated its brand. However, macroeconomic headwinds have slowed that momentum. Between 2022 and 2024, Nokia’s revenues declined from $23.8 billion to $19.2 billion.

Now, with analysts and investors questioning its long-term trajectory, Nokia must prove that its pivot to AI and defense tech is more than a PR play. The company has also adjusted its full-year profit guidance, forecasting €1.6–2.1 billion in profits, down from a prior €1.9–2.4 billion range.