TLDRs;

Contents

- Nvidia warns GAIN AI Act could limit global competition for advanced chips and impact international markets.

- The proposed law would prioritize US domestic orders and require export licenses for high-performance AI chips.

- Despite trade tensions, Nvidia expects AI chip demand to keep rising, with infrastructure spending surging globally.

- Export restrictions create complex market dynamics, offering indirect sales and future opportunities in restricted regions.

Nvidia has voiced strong concerns over the proposed GAIN AI Act, warning that it could hinder global competition in the advanced chip market.

The legislation, currently under consideration as part of the National Defense Authorization Act, would require AI chipmakers to prioritize domestic US orders and seek government licenses for exports of chips that exceed certain performance thresholds.

A Nvidia spokesperson said the bill risks restricting competition worldwide across industries relying on mainstream computing chips. Limiting access for foreign customers could have ripple effects beyond the US, slowing innovation and constraining AI adoption globally.

Mirrors Biden-Era AI Diffusion Rules

The GAIN AI Act closely mirrors the AI Diffusion Rule introduced during former President Joe Biden’s administration. That earlier measure allocated advanced computing resources to allied countries while restricting access for others, particularly China, aiming to prevent the use of AI for military purposes.

Both pieces of legislation reflect ongoing US efforts to maintain a competitive edge in AI and advanced chip technology while controlling strategic exports.

Last month, a deal between former President Donald Trump and Nvidia highlighted the complex trade dynamics in this space. Under the agreement, the US government would receive a portion of Nvidia’s sales in exchange for allowing the company to resume exports of previously banned AI chips to China. Even with such arrangements, Nvidia remains cautious about future market access, particularly in China, where regulatory approvals for new products are still pending.

Nvidia Sees Rising AI Demand Worldwide

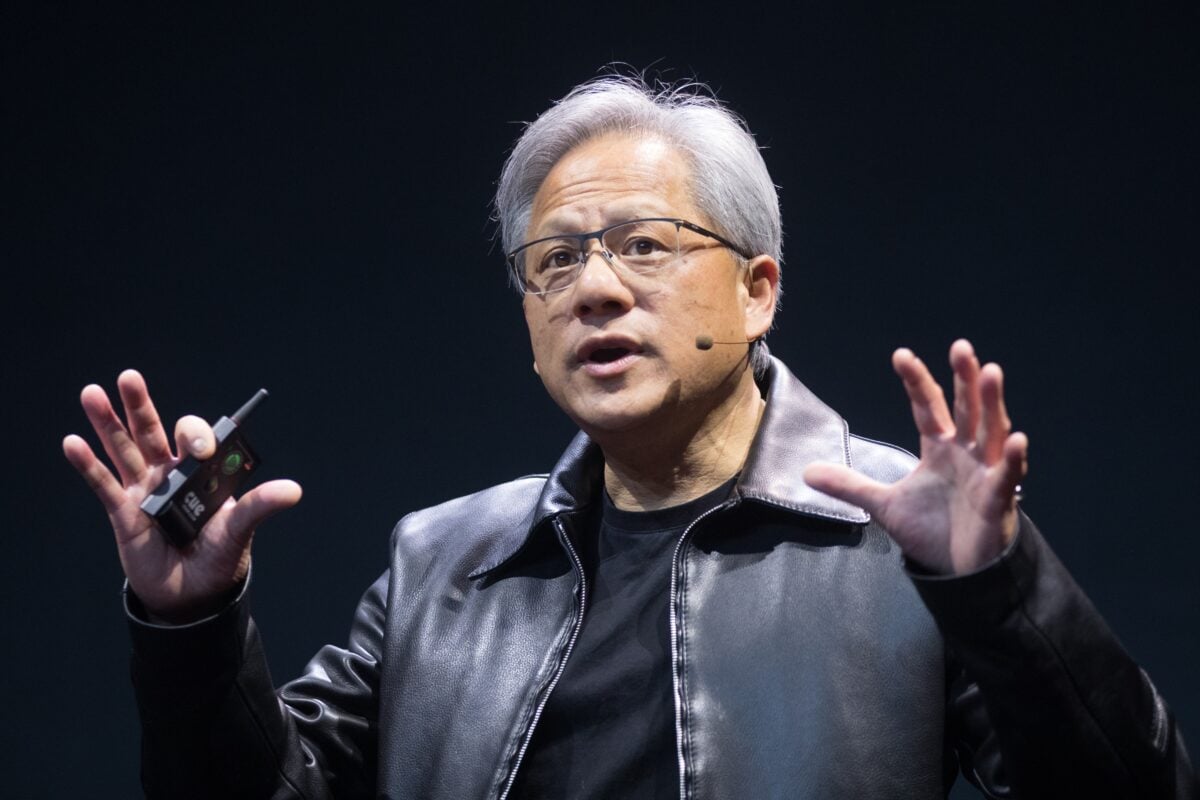

Despite these geopolitical challenges, Nvidia’s CEO Jensen Huang remains optimistic about the overall demand for AI chips. Huang projected that global spending on AI infrastructure could reach between US$3 trillion and US$4 trillion by 2030. He noted that Nvidia’s high-end Blackwell chips are largely reserved through 2026, while Hopper chips continue to experience strong demand.

In the latest quarter, Nvidia recorded US$46.7 billion in revenue, a 56% increase year-over-year, yet the stock fell nearly 2% after the earnings announcement. Analysts suggest this reflects a market that has matured beyond early AI hype, now evaluating sustainable growth rather than celebrating large but expected gains.

A single customer outside China purchased US$650 million worth of H20 chips, which were initially designed for the Chinese market, demonstrating continued international demand even amid trade restrictions.

Geopolitical Limits Reshape Market Opportunities

Industry experts also point out that geopolitical restrictions create complex market dynamics. While Nvidia estimates it has lost roughly US$8 billion in potential Chinese sales due to export controls, the company continues to develop China-specific chips like the B30A to remain prepared for potential regulatory changes.

This strategic approach allows Nvidia to navigate restrictions while positioning itself for future market opportunities once policies shift.

As governments worldwide debate AI export controls, Nvidia’s warnings underline the delicate balance between national security and global technology competition. The GAIN AI Act, intended to protect US interests, may have unintended consequences that ripple across industries reliant on advanced computing, from AI research to high-performance enterprise applications.