TLDRs;

Contents

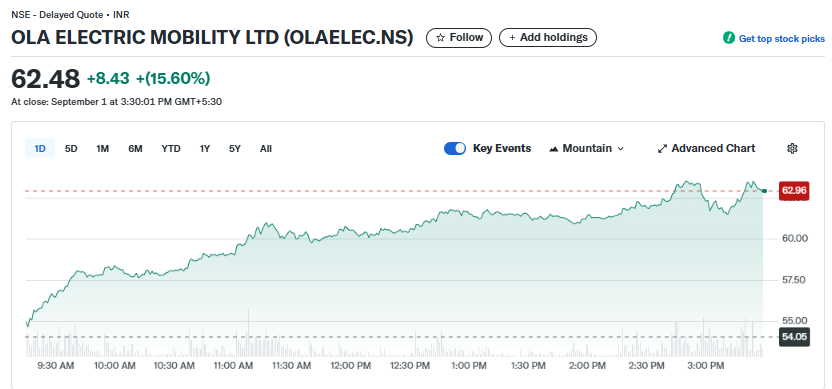

- Ola Electric stock rallied 15.60 % in August after a $5B market rout, fueled by policy support and new battery tech.

- Despite the rebound, shares remain over 60% below their post-listing high, reflecting persistent structural challenges.

- Government PLI incentives covering Ola’s Gen 3 scooters provided immediate margin relief, boosting investor sentiment.

- Analysts remain cautious, warning that positive cash flow generation is key to sustaining Ola’s recovery.

Ola Electric’s shares staged a remarkable rebound, surging 15.60% on September 1, after the Indian e-scooter maker lost nearly $5 billion in market value just a month earlier.

The rally signals renewed investor optimism that the company could be turning a corner, even as fundamental challenges linger.

The Bengaluru-based firm, which once commanded nearly half of India’s electric two-wheeler market, has endured a rocky year marked by slowing sales, safety controversies, and shrinking market share. Yet its unveiling of an indigenously developed lithium-ion cell battery and certification under India’s Production Linked Incentive (PLI) scheme has sparked hopes of stabilization.

Government Incentives Provide a Boost

The PLI approval, covering Ola’s Gen 2 and Gen 3 scooters, allows the company to access incentives worth 13–18% of sales value.

With nearly 80% of sales coming from its Gen 3 line, the scheme offers immediate financial relief at a time when the company has struggled with negative cash flows.

For investors, this policy support proved pivotal. The stock’s sharp rally in August followed the announcement, underscoring how regulatory decisions can rapidly alter market sentiment in emerging industries like electric mobility.

Battery Breakthrough and Product Pipeline

Ola’s development of an indigenous lithium-ion cell marks another critical milestone. For years, Indian EV manufacturers have relied heavily on imported battery technology, leaving them vulnerable to supply chain volatility and cost pressures.

By localizing battery production, Ola not only reduces dependence on imports but also improves margins over time.

The company is also preparing to expand its scooter lineup, targeting both budget-conscious buyers and premium customers. Analysts suggest that new product launches, if paired with consistent quality, could help Ola claw back market share lost to rivals such as Ather Energy and TVS Motor.

Market Leadership No Longer Assured

Ola’s trajectory highlights the volatility of leadership in fast-growing technology sectors. In 2023, the company controlled around 50% of India’s e-scooter market. By mid-2025, that dominance had collapsed to just 20%, as its sales halved while competitors gained ground with steadier execution.

Safety-related setbacks, most notably scooter fire incidents, further dented consumer trust. Combined with operational execution issues, these challenges pushed Ola down to third place in market rankings, proving that early dominance does not guarantee sustained leadership.

Analysts Urge Caution

Despite August’s rally, Ola Electric’s stock remains more than 60% below its post-listing peak. Of the seven analysts tracking the company, three recommend selling, while two suggest holding. Only a minority are optimistic about near-term upside.

Large investors such as Mirae Asset Financial Group and Helios Capital Asset Management have increased stakes, signaling selective institutional confidence. Still, most analysts caution that Ola’s ability to generate positive cash flow in coming quarters will determine whether the recent rebound is sustainable.

With India’s festive season approaching and e-scooter demand expected to rise, Ola has a narrow window to prove its turnaround strategy is working. For now, the company’s stock surge reflects optimism, but the path to long-term recovery remains uncertain.