TLDRs:

Contents

- PayPal beat Q2 earnings and revenue expectations but shares fell due to margin pressure.

- Transaction margin growth slowed to 7%, down from 8% in the previous quarter.

- User engagement metrics show declining transaction frequency per active account.

- PYUSD-backed crypto payments mark long-term vision, but investor focus remains on profitability.

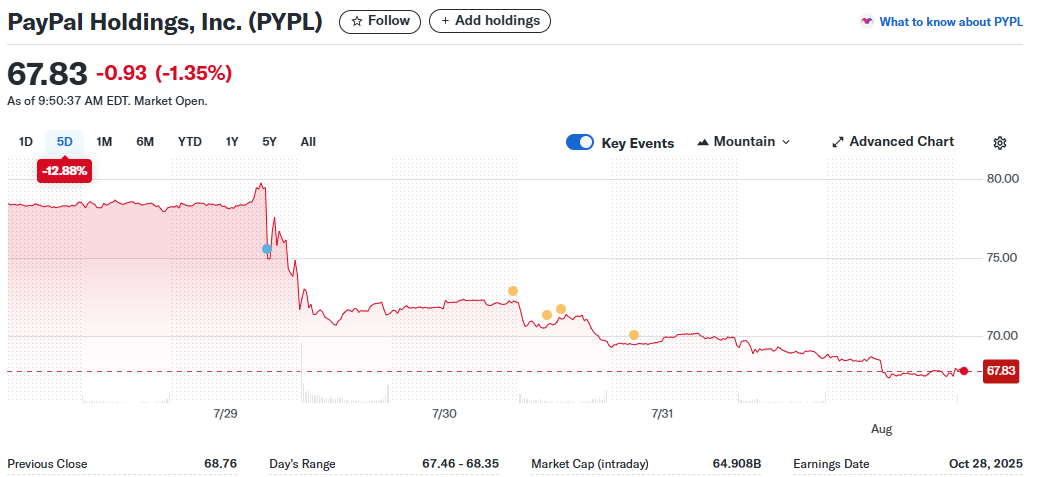

PayPal Holdings, Inc. (PYPL) posted better-than-expected Q2 2025 financial results, but the market remained unconvinced, sending the stock down over 1.2% in after-hours trading on Friday and extending weekly losses to 12.88%.

The company reported adjusted earnings per share of $1.40 on revenue of $8.29 billion, both figures topping analyst estimates compiled by LSEG.

Total payment volume (TPV) climbed to $443.6 billion, up 11% year-over-year and above projections. Active accounts also edged up 2% to reach 438 million. Yet, these seemingly strong numbers were not enough to reassure investors increasingly focused on the company’s weakening transaction margins and user engagement.

Despite the solid top- and bottom-line beats, the primary concern lay in PayPal’s transaction margin dollars, which rose by 7% to $3.84 billion. That growth marked a slowdown from the previous quarter and signaled long-term profitability pressure that’s becoming harder to ignore.

Profitability Concerns Cloud Future Outlook

The company’s guidance for Q3 includes expected adjusted earnings per share between $1.18 and $1.22 and projected transaction margin growth of just 4%.

This trend is part of a broader decline: PayPal’s net profit margin, which peaked at 20.35% in 2020, is forecast to fall to around 18.5% by 2025.

By comparison, tech giants like Apple maintain net margins as high as 24.3%, highlighting PayPal’s lag in profitability efficiency. This competitive gap could reduce the company’s agility in reinvesting in innovation or navigating economic headwinds.

Analysts argue the company is facing structural challenges in a crowded digital payments market. Increased competition from fintech disruptors and big tech firms has likely placed downward pressure on both margins and market share retention.

User Engagement Weakness Adds to Investor Worry

Even as total dollar volume grew, user behavior painted a more troubling picture. The number of transactions per active account dropped 4% on a trailing 12-month basis, and the total number of transactions fell 5% to 6.2 billion for the quarter.

These trends suggest that fewer users are engaging frequently with PayPal, raising questions about the platform’s long-term stickiness.

While high-value transactions are growing, they are not necessarily a sign of strong consumer engagement, which remains essential in the face of competition from more interactive fintech platforms.

Crypto Push Reflects Long-Term Strategic Bet

Just days before releasing its Q2 results, PayPal also made waves by launching “Pay with Crypto,” a tool enabling U.S. merchants to accept cryptocurrency payments through its PYUSD stablecoin. The service supports a range of wallets and blockchains, including Coinbase, MetaMask, and Uniswap.

PYUSD, now the 12th-largest stablecoin with a $900 million market cap, plays a crucial role in PayPal’s strategy to balance decentralization with platform control. All supported cryptocurrencies are converted into PYUSD during transactions, enabling PayPal to maintain oversight and reduce volatility.

This move is the culmination of nearly a decade of strategic preparation, from investing in blockchain identity startups to developing in-house stablecoin infrastructure. However, investors appear more focused on near-term financial health than long-term innovation.