TLDRs;

Contents

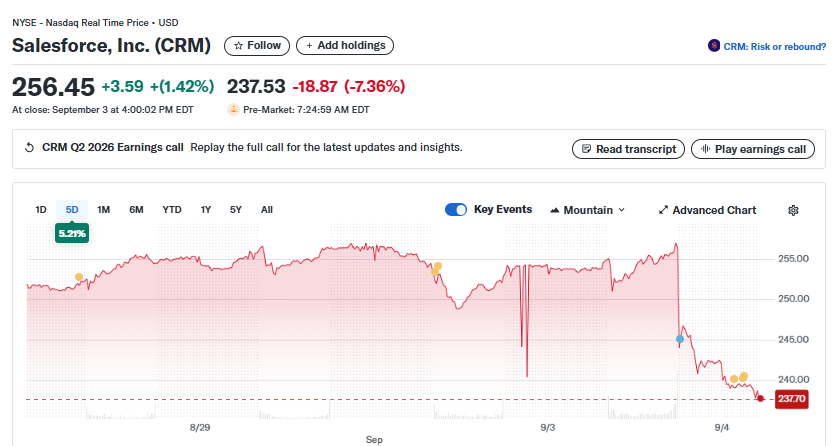

- Salesforce stock fell 7.36% to $237.70 after weak Q3 revenue guidance and slower-than-expected AI monetization.

- The company expanded its buyback program by $20B, but investors worry AI investments won’t deliver immediate returns.

- Despite AI integration via Agentforce and 4,000 job cuts, economic uncertainty is slowing enterprise adoption of AI tools.

- Salesforce’s challenges mirror a broader tech industry struggle where massive AI spending outpaces near-term revenue growth.

Salesforce, Inc. (CRM) shares slid 7.36% to $237.70 in pre-market trading on Wednesday after the company issued a cautious third-quarter revenue forecast.

The decline came despite announcing a $20 billion expansion of its share buyback program, underscoring investor anxiety over the pace of its artificial intelligence (AI) monetization strategy.

The company projects Q3 revenue between $10.2 billion and $10.3 billion, with the midpoint falling short of analyst expectations. Adjusted earnings are expected to land in the range of $2.80 to $2.90 per share, a figure that did little to ease market concerns.

AI Integration, But Revenue Lags

Salesforce has invested heavily in weaving AI capabilities into its core cloud offerings, most notably through its Agentforce platform. The technology aims to automate workflows, cut costs, and boost customer engagement, aligning with CEO Marc Benioff’s vision of a more efficient Salesforce ecosystem.

Yet, the financial results tell a different story. Despite widespread AI adoption internally, the company is struggling to generate meaningful short-term revenue gains from these investments.

Benioff revealed that Salesforce had already cut 4,000 customer support jobs, with AI now handling a large share of routine tasks. While cost savings are evident, investors remain unconvinced that AI-driven efficiencies will quickly translate into top-line growth.

Economic Uncertainty Adds Pressure

Macroeconomic headwinds are amplifying Salesforce’s struggles. Many corporate clients are scaling back IT budgets and delaying major software upgrades, leading to slower-than-expected adoption of AI-powered solutions.

The mismatch between Salesforce’s aggressive AI investment and customer readiness has become increasingly apparent.

According to industry research, while 90% of organizations believe AI can provide a competitive advantage, only about 22% have a clear AI strategy in place. This gap leaves Salesforce with advanced tools but a customer base hesitant or financially constrained, to fully embrace them.

Broader AI Industry Challenges

Salesforce’s struggles reflect a broader challenge across the tech industry. Global AI investments are massive, with the market estimated at $391 billion in 2024 and projected to soar to $1.81 trillion by 2030. However, the pace of revenue growth has not matched the speed of investment.

In 2025, major tech companies are expected to pour $364 billion into data centers, yet converting this capital into immediate revenue remains elusive.

Salesforce’s situation illustrates the difficulty of monetizing AI platforms when enterprise customers are still working through adoption bottlenecks.