TLDRs:

Contents

- Tesla’s May sales in Europe fell 27.9%, despite overall electric vehicle demand in the region growing by 27.2%.

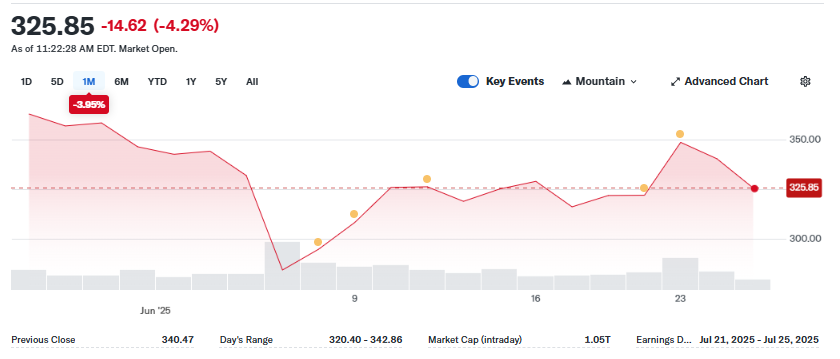

- TSLA stock dropped 4.29% to $325.85, reflecting investor concerns over shrinking market share and mounting competition.

- Chinese automakers like BYD and MG are gaining ground, offering cheaper EVs with advanced tech, pressuring Tesla’s pricing model.

- Tesla faces policy uncertainty in Europe, with reduced subsidies and shifting consumer preferences further impacting its performance.

Tesla’s stock took a notable hit on Wednesday morning, falling 4.29% to $325.85 after European car sales data revealed a sharp decline in the company’s performance across the region.

According to the European Automobile Manufacturers Association (ACEA), Tesla’s vehicle sales dropped 27.9% in May 2025 compared to the same period last year, even as the broader European electric vehicle market expanded significantly.

Tesla Loses Ground in a Growing Market

While the European electric vehicle sector surged by over 27% in May, Tesla’s performance told a very different story. The company’s sales slump pulled its EU market share down from 1.8% to just 1.2% year-over-year. Germany, Tesla’s largest European market, has been particularly tough, with sales plunging by over 60% in early 2025.

Analysts see this as a stark reversal from Tesla’s once-dominant run in the region, especially when compared to the brand’s explosive growth following the 2019 Model 3 launch.

Tesla had previously commanded nearly a third of Europe’s EV market, but those days appear distant now. With German rivals like Volkswagen capturing significant domestic market share, and Chinese automakers such as BYD and MG offering lower-cost alternatives, Tesla’s dominance is steadily eroding.

Stock Slides as Sales Struggle

Tesla’s stock opened sharply lower, trading at $325.85 by late morning in New York, down $14.62 from the previous close. The slide followed the disappointing European sales figures and raised concerns among investors about the company’s ability to retain its global footing in the face of intensifying competition. The 4.29% drop in share price puts Tesla under added pressure ahead of its earnings call expected between July 21 and July 25.

Despite rolling out an updated Model Y, Tesla hasn’t managed to stem the loss in market share. Its product pricing remains a sticking point, especially as European buyers increasingly prioritize affordability and practicality over brand prestige or advanced tech offerings.

Policy Shifts and Chinese Rivals Add Pressure

Tesla’s shrinking footprint in Europe also highlights the volatility of government-led EV incentives. In previous years, the brand benefited from a surge in demand triggered by subsidy deadlines, but recent rollbacks in France and Germany have reversed some of those gains. This inconsistent policy environment has exposed Tesla to sharp swings in sales, in contrast to countries like Norway that maintain stable support for EV adoption.

Meanwhile, China’s EV giants are capitalizing on both cost and tech. Firms like BYD have begun bundling sophisticated self-driving features into vehicles priced significantly lower than Tesla’s, turning heads among European consumers. With Tesla charging a premium for features like Full Self-Driving, the contrast in value propositions has become increasingly apparent.

A Shift in Consumer Behavior Undermines Tesla’s Model

The European EV market is maturing, and consumers are no longer just early adopters. Cost-conscious buyers are now steering the transition, opting for more affordable electric and hybrid models. Surveys show that battery range and price are top priorities for today’s consumers, narrowing the advantage Tesla once enjoyed as a tech-forward luxury brand.

With new players offering compelling alternatives at lower price points and government support tapering off, Tesla faces a dual challenge: regaining market share and restoring investor confidence. Until it can do both, its performance in key markets like Europe will remain a source of concern.