TLDRs

Contents

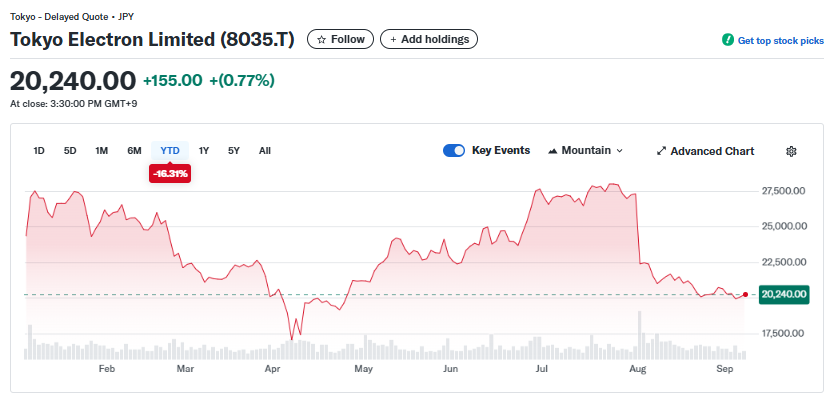

- Tokyo Electron shares are down 16% YTD, underperforming despite global semiconductor growth fueled by AI demand.

- Heavy reliance on Samsung, Intel, and China limits Tokyo Electron’s participation in the AI-driven chip boom.

- Rival Advantest gained 22% this year, benefiting from customers more directly tied to AI growth.

- US sanctions and China’s slowing economy amplify Tokyo Electron’s risks, leaving its outlook uncertain.

Tokyo Electron, one of Japan’s leading semiconductor equipment manufacturers, has emerged as one of the weakest performers in Asia’s chip sector this year.

Shares of the company have slumped 16.31% year-to-date, contrasting sharply with the wider semiconductor industry’s AI-driven surge.

The company’s fortunes are tightly tied to a handful of clients. In the June 2025 quarter, Samsung accounted for over 10% of its revenue, Intel made up 8%, and the Chinese market contributed nearly 39%. Both Samsung and Intel are struggling to fully capture AI momentum.

Samsung’s semiconductor unit reported a staggering 94% plunge in quarterly profit, while Intel continues to focus on cost-cutting instead of cutting-edge AI innovation.

This dependence has left Tokyo Electron on the sidelines of a booming industry, even as global semiconductor sales are projected by Deloitte to climb from $627 billion in 2024 to $697 billion in 2025, powered largely by AI demand.

Industry Rivals Capitalize on AI Growth

The divergence between Tokyo Electron and its peers underscores the importance of customer mix in the chip equipment sector.

While Tokyo Electron’s performance has sagged, competitor Advantest has seen its stock jump 22% in 2025, becoming a favorite among investors looking for AI exposure.

Analysts note that Advantest benefits from stronger alignment with customers riding the AI wave, making it better positioned for growth in the current cycle. The contrasting trajectories show how equipment suppliers can either thrive or falter depending on their clients’ ability to monetize AI-driven demand.

China Exposure Deepens Risks

Another major factor weighing on Tokyo Electron is its reliance on China, which contributes nearly 40% of its total revenue. This geographic concentration poses serious risks, especially as U.S. sanctions tighten and Beijing accelerates efforts toward tech self-sufficiency.

Chinese chipmakers, once heavy buyers of Tokyo Electron’s equipment in anticipation of export restrictions, have reduced purchases amid slowing economic conditions. This shift has left the company more vulnerable than competitors with diversified geographic footprints.

Investors are increasingly evaluating semiconductor companies not only on operational performance but also on geopolitical exposure. For Tokyo Electron, its deep ties with China have become a liability at a time when the semiconductor industry is fragmenting along political lines.

Outlook Remains Clouded

The company has already lowered its annual earnings outlook, citing weaker-than-expected demand from logic-chip makers and uncertain conditions in its key markets.

Analysts warn that unless Tokyo Electron diversifies its customer base and reduces reliance on China, it risks falling further behind rivals who are better positioned to capture AI-related growth.

That said, the broader industry remains robust, with U.S. AI investment hitting $109.1 billion in 2024 alone. Yet Tokyo Electron’s struggles illustrate how even in times of industry-wide expansion, individual players can falter if tied too closely to struggling clients and high-risk markets.