TLDRs:

Contents

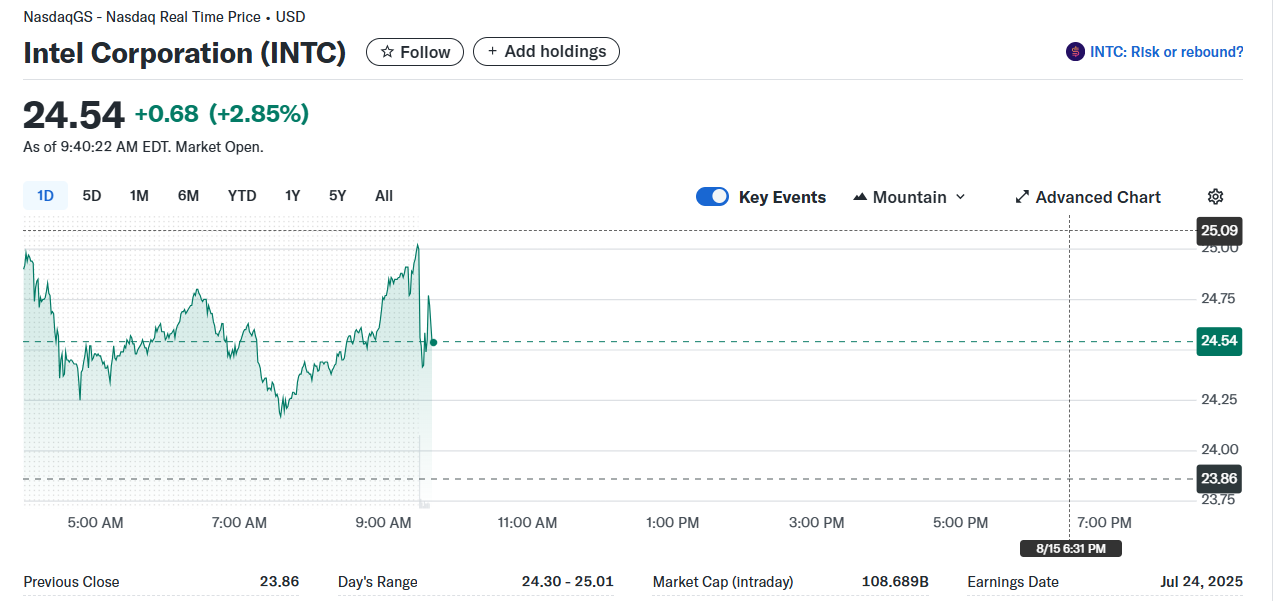

- Intel’s Frankfurt shares rise 2.85% after report of potential US government stake.

- US administration reportedly in talks to invest in Intel amid chip sector strategic push.

- Move seen as part of national security and technological competitiveness strategy.

- Intel’s manufacturing struggles highlight challenges despite potential government support.

Intel Corp.’s Frankfurt-listed shares climbed 2.85% on Friday after reports that the US government is in talks to potentially acquire a stake in the chipmaker.

The discussions, reportedly involving the Trump administration, come as Intel faces mounting competition from Taiwan Semiconductor Manufacturing Co. (TSMC) and navigates ongoing manufacturing challenges.

The rally extended an earlier surge in US trading, where Intel’s shares jumped over 7% on Thursday and gained another 2.6% after hours. Investors viewed the potential federal investment as a strong signal of long-term confidence in the company’s strategic role in semiconductor manufacturing.

Historical Precedent and Strategic Imperative

Analysts note that federal investment in key technology firms is not new. The US government spends nearly $200 billion annually on research and development, with a long history of boosting critical industries.

Past government contracts, from NASA to the Department of Defense, have catalyzed entire technology sectors.

In the context of national security, semiconductors are now considered a vital resource, critical to both civilian technology and military applications. This has positioned companies like Intel at the intersection of economic strategy and defense policy, making them prime candidates for targeted investment.

Intel’s 18A Manufacturing Process Faces Yield Challenges

Despite renewed investor optimism, Intel’s operational struggles remain significant. Sources indicate the company’s next-generation 18A manufacturing process, intended to produce advanced chips like the Panther Lake processors in 2025, is experiencing low yield rates.

Only about 10% of chips produced with 18A reportedly meet quality standards, up from roughly 5% late last year. Intel disputes these numbers but acknowledges that margins will remain under pressure until yields improve. The company still relies partially on TSMC for manufacturing, underscoring its dependence on foreign foundries despite its domestic expansion push.

Competition with TSMC Highlights Intel’s Strategic Crossroads

Intel’s manufacturing delays echo its past struggles with the 10nm process, which took years longer than planned to reach high-volume production. In contrast, TSMC currently leads the process technology race by one to two generations, attracting major clients like AMD and Nvidia.

The potential US government stake could provide Intel with capital and political backing to accelerate development, but execution risk remains high. Industry observers suggest that while government involvement may enhance market confidence, Intel must still solve its technical bottlenecks to regain leadership.